With the U.S. presidential contest down to two players, it’s time to start thinking about the impact of either Hillary or Donald in the Oval Office. The truth is that there will be little impact to self-storage regardless of who is elected. Whether the economy improves or declines, the need for affordable housing is a constant. While there are industries that are highly concerned about who wins the election, self-storage is not one of those. Whether our country become red or blue in November, your facility should remain in the green. Be thankful that the industry has strong enough fundamentals that you don’t have to make an educated guess on this most difficult political battle. You can afford to be wrong.

Memo From Frank & Dave

Why The Self-Storage Industry Has Become Unstoppable

If you’ve been watching superhero movies this summer, then you know that there’s something calming about things so powerful that they can’t be stopped. And self-storage has become one of those things. Although the industry is only around 40 years old, it has developed into a seasoned business model with a track record of success regardless of the state of the economy. So why has self-storage become unstoppable?

Recession-resistant business model

Since the U.S. economy entered the Great Recession of 2007, the self-storage business model has proven to do exceptionally well. Prior to this, there had never been a real test of self-storage as far as its performance in tough economic times. But it proved that it does as well – or even better – in bust than it does in boom. The reason is that uncertainty and upheaval increase demand for storage, as people who are unstable like to store their items in a stable environment until their fortunes improve.

Simple model that cannot become obsolete

Manufacturers of cellular phones live scared. Every day they run the risk of another company inventing a new technology that makes their product impossible to sell. But self-storage has no chance of becoming obsolete, as its business model is too simple to modify. There’s no way to refine three walls, a roll-up door, and a lightbulb. Of course, there have been some changes to the product line, including climate control. But the basic storage unit – the one used by 99% of customers – has no risk of modernization.

Superior collections methods

In many forms of real estate, collections is an essential part of the business model. Self-storage is no different, yet it has a unique hook to its collections function: if you don’t pay the rent, you’re stuff gets sold to pay the rent. This penalty makes self-storage collections extremely strong.

Lowest default rate equals huge lender support

Self-storage is the only form of commercial real estate that has a single-digit rate of default, coming in at around 8%. Apartments have roughly twice that. The extremely low rate of default makes self-storage extremely attractive to banks throughout the U.S., regardless of loan size. There are very few storage deals that die due to lack of financing availability.

The power of Public Storage and their unique construction

One factor that makes self-storage unstoppable is that it is backstopped by its largest owner’s unusual construction. Public Storage, the biggest player in the U.S., has built its business model on a near absence of debt. Without debt, it is immune to gyrations in interest rates and economic decline. As a result, they are an unbelievably strong addition to the industry, representing a solid 800 pound gorilla that never weakens and continues to buy new properties regardless of the external economic forces.

Conclusion

Self-storage has become unstoppable through a number of issues that have proven to be resilient regardless of the U.S. economic condition. This freight train of a business continues to gain strength, and to reward those that get on board.

Self Storage Home Study Course

Our Home Study Course is not like anything you have ever listened to or read before. We do not fill it with a bunch of fluff on how your are going to make a million bucks with no money down. We tell you the whole story... the good, the bad, and the sometimes ugly.

Click Here for more information.

Simple Signs Of A Growth Market

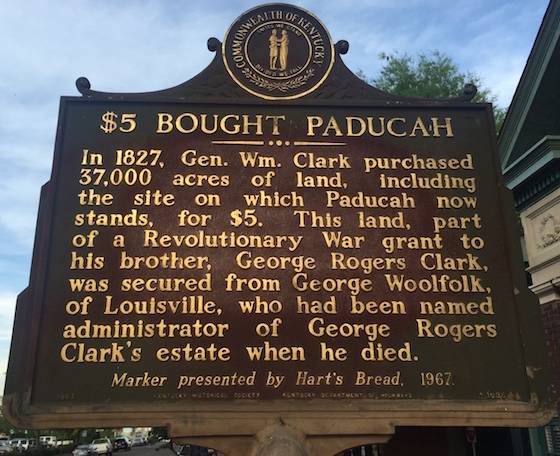

The entire city of Paducah, Kentucky was originally purchased for $5. That would have been a really good purchase. But there are other cities out there that might make you want to get your money back. In any self-storage investment, you are betting on the macro market as much as the property itself. So how can you tell if a city is going to be a winner or a loser over the decades ahead?

Walmart

There is perhaps no greater affirmation of future value than the existence of a Wal-Mart in your market. Wal-Mart has the best due diligence team in the U.S., and their site selection is superior to any other group. What makes Walmart unique is that they don’t just measure the current environment, but they take an array of variables to decide on the future performance of a market. That’s why you often see them building in what appears to be rural areas, only to find it cosmopolitan years later. It’s not luck. It’s superior site selection. If you have a Walmart in your market, that’s one of the purest signs of future success for your self-storage facility.

Top Ten Employers

You have to have jobs to have people living in a market. And you have to have people to rent storage units. So any strong market has to have strong employment. One of the key ways we measure employment is through unemployment numbers. The U.S. average is around 6.2% currently, yet there are markets out there with half that rate. What these markets share is a strong set of diverse employers that are “recession-resistant”. The best way to determine if a market has what it takes is to get a list of the top ten employers and the number of people they employ. Good markets have a diversity in which no one group dominates and, if there is one huge employer, it’s not a private enterprise but rather a hospital, college, or other public entity that is not subject to layoffs. It’s also good to have a diverse mix of industries, so the market can withstand the removal of one job sector.

Future road plans

The highway department, in most states, produces a written report of future road projects. These reports can be hugely enlightening as to the growth of a market. If you simply map out all of these roads in progress, you can see clearly where the path of growth is. You only need new roads to handle greater traffic, and you typically see greater development where there is more traffic. Areas that have little future typically have little in the way of future road projects.

Quality of school district

There is perhaps no greater symbol of a strong market than a good school district. A good school district suggests a higher income, higher home prices, and a more desirable place to live. It also exemplifies plenty of materialism that needs a good place to store it. It is very rare for an area with a great school district to decline, as it is always in demand regardless of what goes on in the macro economy.

Single family median home price vs. the market metro

You can spot superior markets by their median home price – they’re always high. The median home price in the U.S. is around $170,000. If you’re looking at a market with $60,000 home prices, that’s a bad sign that there is little growth and therefore demand for housing. A heavy influx of people creates higher home prices. And you can see how your market compares to the metro market by going to www.Bestplaces.net and comparing the metro median home price to that of your specific market niche.

Published stats

Another place to find estimates of growth are on the internet. www.Bestplaces.com displays them, but you can also find stats on Wikipedia and the Chamber of Commerce websites. These statistics are extremely telling. Remember that population numbers alone do not tell the whole story (a growing market or poor people have little to store) but solid growth is a key part of any market’s future performance, as a shrinking market will lead to reductions in demand and lower real estate prices.

Conclusion

You do not need a crystal ball to ascertain the growth potential of a market. You need to make sure that any city or town you are looking at buying a self-storage facility in has a healthy future to ensure that your property will always have plenty of demand and acceptance.

How A Good Manager “Rides The Wave”

Dave Thomas, the founder of Wendy’s, often spoke about the necessity of finding managers that can “ride the wave” and be ahead of problems rather than reactively trying to fix those issues they could have prevented. And this is as important a concept for any self-storage owner as it is for a Wendy’s franchisee.

Anticipates problems

Dave Thomas describes the difference between a good and bad manager regarding pickles. The good manager sees that the pickles are running low, extrapolates the daily demand for pickles, and makes sure that he buys more. The bad manager does not know that the pickles are running low until an employee tells them, then has to leave the store to buy the pickles (which results in the store falling apart) and then before they get back there are no pickles, which infuriates the customers. A good manager anticipates each step and problem before they occur.

Remembers past mistakes

A good manager is constantly learning. They memorize patterns and remember past mistakes. This puts them in a position to make intelligent guesses. There’s an old saying that “fooled once, shame on you and fooled twice, shame on me”. A good manager never makes the same mistake twice.

Is constantly watching for anomalies and opportunities

Dave Thomas himself spotted the anomaly that led to his first success as the creator of Kentucky Fried Chicken. He saw that people were wanting fast dinners at low prices, and knew that a failed chicken restaurant had a future if the product could be delivered fast and cheap. He invented the concept of a bucket of chicken at an affordable price. Good managers are always on the lookout for opportunities to improve the business’ sales and margins, and this allows them to stay ahead of the pack.

Stays immersed in market details

A good manager is constantly staying on top of the information flow. They watch the daily stats and the competition. This gives them the ability to pivot quickly to meet market conditions. If your self-storage is priced too high or low, you need that information immediately to either gain market share, or to lower prices before you lose customers. Being a good manager is more than a 9 to 5 job – you need to keep your head in the game at all times to stay on top of the wave of data.

Understands the drivers to profitability

A good manager needs to know what makes money, and put their emphasis on that. A bad manager does not prioritize their time on what really makes money, and treats all tasks equally. Obviously, you want your self-storage manager signing up new customers more than you want them picking up litter, and you want them focused on cutting electricity costs more than reducing the number of highlighters in the office cabinet.

Conclusion

A good manager is like a surfer who stays on the forefront of the wave without having the safe roll over them. Dave Thomas found this out early, and you should adopt this as the most important part of interviewing new candidates and grading current ones.

New Facilities for Sale on SelfStorages.com

How To Proactively Solve Problems And Save A Fortune

We live in a litigious world. But there’s no reason that you have to endure lawsuits and threats of financial penalties. There are proactive steps to solving problems and saving a fortune.

Identify problems before they happen

99% off all lawsuits can be spotted before they ever occur. You can see the sidewalk has buckled and presents a slip and fall claim. And that the security gate is not really working and makes it possible for someone to break in. When you see problems, fix them before they fester into a real catastrophe. Most owners get into trouble because of their own procrastination.

Carry sufficient insurance

Insurance is of no value if you do not carry enough. How much is enough? In today’s world, at least a million dollars or more. That gives you plenty of protection regardless of what happens. Remember that most suits are brought on a contingency basis, and you have to allow room for the attorney to have a big payday. Small limits will not help you at all.

Watch for opportunities for permanent solutions instead of quick fixes

Whenever you have a problem, you need to think through what a permanent fix would be as opposed to a quick fix. Your goal should be to remove all risks from the property, not just gloss over them. If a car hits the corner of the building, you should consider installing a barrier to stop it from happening again, rather than patch the building and wait for it to happen again.

Conclusion

There are easy steps you can take to avoid problems and to walk away without losing money when they occur. Take preventive measures and sleep well at night.

Brought To You By SelfStoragesUniversity.com

If you need more information please call us (855) 879-2738 or Email [email protected]