If you look at many of the stocks in the U.S., you’ll see that they are trading at “price to earnings” (PE) ratios of 100, 200 – even infinity. Let’s compare that to a typical self-storage facility, which trades – based on an 8% cap rate – at a PE of roughly 13. While most stock investors have lost track of the entire concept of pegging a stock’s price to a multiple of its earnings, real estate investors refuse to waiver from a PE range of roughly 10 to 20. In most cases, that’s roughly 10 times less speculation than stock investors seem to be comfortable with. And then there are stocks like Tesla that have an “infinite” PE since it has never posted a profit in company history. In a world of insane stock valuations, self-storage has remained immune to crazy thinking. People talk about a coming collapse in the stock market – and they’re probably right. That’s the risk you run when you do not tie values back to actual earnings. Personally, we’d far rather own a good old boring storage facility at a 13 PE ratio than Clear Channel at 282 PE, and that’s why we ignore each day’s wild market gyrations.

Memo From Frank & Dave

What Are The Top Three Dangers That Can Cause Your Self-Storage Facility Significant Harm?

How many times have you been driving down the highway, feeling good about life, and then suddenly hit a speed-trap and ended up with a large fine and a sour attitude. If you had only known there was a cop with a radar gun over that next hill. Well, we can’t tell you where the risks are on your drive we can tell you what the top three risks in owning a self-storage facility are, and how you can mitigate them.

Wrongful sale

Believe it or not, this is the largest danger you have as a self-storage facility owner. A “wrongful sale” is when you auction off the contents of a storage unit for non-payment without following the law on how these sales are to be conducted, or even selling off a unit that is actually current on rent and was simply mis-labelled by the manager. What’s so damaging about these cases is that juries can rewards literally millions of dollars of damages to the renter, who invariably claims that the unit had contained priceless antiques and personal effects that are irreplaceable and they can’t live without (when it was actually a used Christmas tree from Walmart). Remember that this is America 2018 and the court system is a scandal – no sane individual wants to get involved in letting a judge or jury dictate your fate. So how do you guard against this danger? The first is to make sure that you have triple-checked the lease and payment records before you even think about taking a unit to auction. Try to make contact with the customer and make sure they understand the ramifications of not paying, and that they have been duly served. Take massive amount of photos of the unit contents so that you have a record of what was actually in there. And make sure that you have insurance that covers this potential mess. The average auction in the U.S. only yields roughly $100 (don’t tell the TV show “Storage Wars”) and that’s not compelling enough to even begin to risk litigation.

Bad manager

You probably already guessed this one. A bad manager can quickly destroy a good storage business. The average storage facility has roughly 10% of its contracts renew each month, and a bad manager can literally run off your customers in one short year. Bad managers are those that 1) have poor people skills 2) fail to properly maintain advertising/marketing programs 3) does not keep the facility up to reasonable standards 4) fails to properly mark and monitor leases and payments 5) ignores the rent specials of competitors and 6) embezzles revenue. How do you detect these weak links and eradicate them quickly? The key is to build systems and monitor that they are being followed effectively. Such items as collections, occupancy and budget adherence should be tightly watched and -- if there is an alarming trend -- to replace the manager immediately. You should also frequently “mystery shop” your manager (pretend to be a customer and see how they perform). You can also do periodic customer surveys to see the experience that your manager is giving your customer base.

Unforeseen competition

When you do the due diligence prior to buying or building a storage facility, it’s imperative that you factually identify the potential for new construction near your investment. Many a storage deal has been negatively impacted – or flat out ruined – by the construction of new competition across the street or next door. Storage requires certain zonings as well as cost of land and road frontage. Don’t ignore the potential for new competition simply because you like the deal you’re working on. Put on lab coat and make sure you have 100% visibility of where those other storage facilities can go.

Conclusion

Owning a storage facility does not come with a lot of risks, but these three are the top ones. Acknowledge what they are and build programs to mitigate them. Unlike that speed trap, you don’t have to end up with a problem without notice – if you follow these tips.

Self Storage Home Study Course

Our Home Study Course is not like anything you have ever listened to or read before. We do not fill it with a bunch of fluff on how your are going to make a million bucks with no money down. We tell you the whole story... the good, the bad, and the sometimes ugly.

Click Here for more information.

Three Top Industry Sayings And Why

Self-storage owners are always looking for simple sayings to remind themselves of what’s important in operating their business. Unlike a Johnny Cash song about prisons, dogs and pick-up trucks, these ritual sayings are not designed to entertain, but to help to make money. So what are these popular jingles?

“It’s the manager, stupid”

When things are not going as planned with a storage investment, the problem typically always revolves around the manager. They are the party that handles everything from marketing to customer interaction, and a weak one can sink your ship in short order. It’s no mystery. So when you are suddenly not hitting your budgets, you don’t need to spend a lot of time wondering “what went wrong” because “it’s the manager, stupid”. Look no further.

“It’s easier to change people than to change people”

This again relates back to the manager. The fact is that you, as a storage owner, are not in the people re-training business. When a manager is not working out, there’s no way you are going to send them to substance counseling or anger management training. That’s the domain of giant companies like IBM. Instead, you’re simply going to fire and replace them. It may sound cruel, but it’s a necessity. You have no time to waste. A bad manager can destroy you. Don’t procrastinate. Change people immediately. Stanley Marcus – the founder of Neiman Marcus – once said “take your markdowns on people and merchandise as quickly as possible”. That’s the spirit.

“When in doubt, pull it out”

This saying ties back to the “wrongful sale” risk discussed in an article above. It means that, before you even think about putting an unpaid unit up for auction, you have to either be 100% sure that you’ve done everything perfectly, or pull out the entire file for that unit and make sure that you have the correct lease, demand letter, correspondence – everything. Never let a manager take action without having 100% clarity of the situation. They can afford to take risks because they have no assets and nothing to lose. You can’t. When you feel that something may be off-base, demand to see the complete file.

Conclusion

It may not be Nashville, but these three tunes will keep your self-storage facility out of trouble and on the right track. Make these your #1 hits.

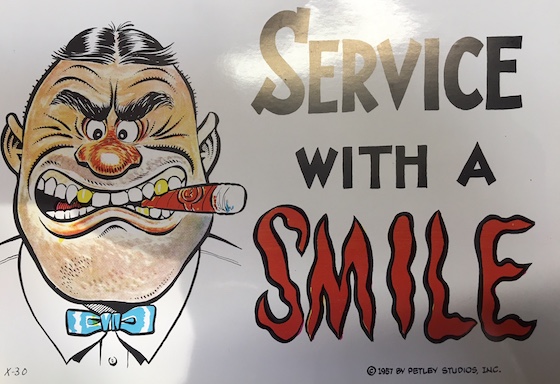

How Are Your Manager’s Phone Skills?

Have you ever noticed that a good manager has the ability to “smile” over the phone. They have such innate sales skills that their enthusiasm exudes through the phone line and the customer feels an immediate bond and desire to give your facility their business. Does your manager have this special “knack”? Find out by “mystery shopping” your facility on a regular basis – the more the better. Call at different times of day, and pretend that you are looking at renting a unit. See if they answer the phone quickly or let it ring ten times. See what they say and how they say it. Would you rent there? Or were you totally turned off? Your customers will be having the same experience that you had. Be sure and *67 your phone to shut off all caller I.D. before you make that mystery shopping call.

How To Be A Storage Deal Maker And Not A Deal Killer

When you’re looking at a storage facility to buy, there are two approaches you can take: 1) being a deal killer or 2) being a deal maker. The difference is the attitude with which you approach each potential property. And one yields successful deals, and the other typically leads to complete failure in finding the right storage facility to buy.

Don’t take the easy way out

A “deal killer” mentality has one terrible attribute – it always takes the path of least resistance. And that path rarely leads to a successful acquisition. It’s super easy to look at any deal, find one or two flaws and say “no”. The problem is that every deal has one or two flaws and, as a result, you’ll never buy anything – including good properties that would have made you money. Anyone can be a “deal killer”; it takes no skill or thought to simply say “no”.

Learn to find creative ways to make a deal work

A “deal maker” has a different approach. They look at every deal and think “now how could I make this deal into a success?” A “deal maker” is a creative thinker, and one that is always watching out for opportunities. You’d be surprised how many storage deals that can go from bad to great with a significant change in the structure like the price and terms, as well as solid strategies on the occupancy and costs. If a deal has a net income of $100,000 and is worth $1,250,000 at an 8% cap rate, and the seller prices it at $1,800,000, that does not mean that you should walk away. Instead, try to get the price down, or the seller to carry the financing at a lower rate, or do a Master Lease with Option, or come with a realistic strategy to boost the NOI. Model some creative alternatives. Even if you’re unable to ultimately put the deal together, at least you’ll learn a lot that may help you on the next transaction.

Learn to negotiate better to make difficult deals possible

Each deal that the “deal maker” works on enhances their negotiation skills. Practice makes perfect, and after doing a series of complicated negotiations in trying to figure out how to make a deal work, the end result is that the buyer ultimately has terrific skills. These skills will give them the decided advantage when they find that perfect deal that has the winning combination of location, price and terms. “Deal killers”, on the other hand, get no such practice and, as a result, never improve in their abilities. Head-to-head, the “deal maker” always clobbers the “deal killer” in any transaction.

Conclusion

Being a “deal killer” is easy and unprofitable. Being a “deal maker” opens the door to many more transactions –often some of the best – and gives you the skills needed to put substantial deals together. Don’t fall into a trap – the “easy way out” – and start just saying “no” to every storage deal you see. Take the harder path and you’ll be much more successful.

Brought To You By SelfStoragesUniversity.com

If you need more information please call us (855) 879-2738 or Email [email protected]